ADA Price Prediction: Path to $1 Amid Technical Strength and Whale Activity

#ADA

- Technical indicators show ADA trading above key moving averages with improving momentum signals

- Whale accumulation of 20 million ADA demonstrates strong institutional interest despite volume decline

- Bollinger Band positioning suggests potential breakout toward $1 resistance level in near term

ADA Price Prediction

Technical Analysis: ADA Shows Bullish Momentum Toward $1

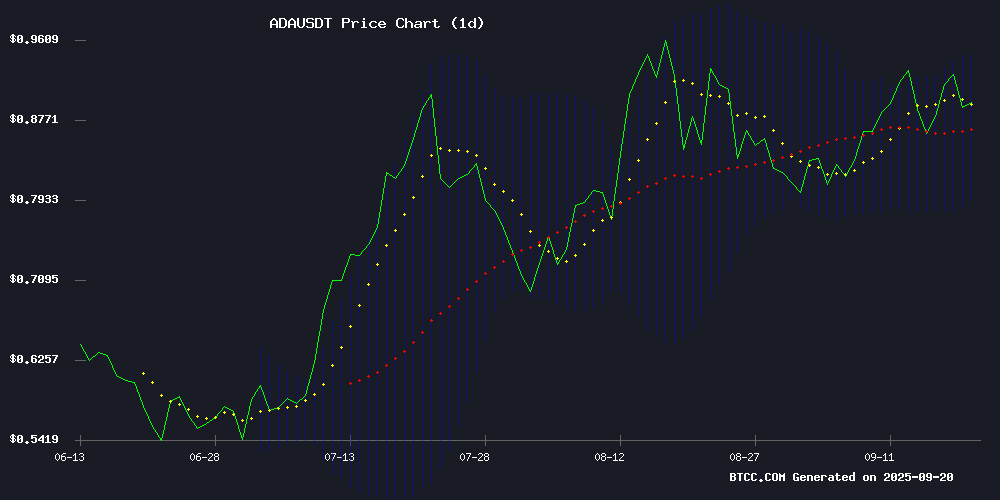

According to BTCC financial analyst Ava, ADA's current price of $0.8934 sits above its 20-day moving average of $0.8688, indicating underlying strength. The MACD reading of -0.0407, though negative, shows improving momentum as the histogram narrows. Trading NEAR the upper Bollinger Band at $0.945 suggests potential for further upside movement toward the $1 psychological level.

Market Sentiment: Mixed Signals Amid Whale Accumulation

BTCC financial analyst Ava notes that while Cardano whales have accumulated 20 million ADA, signaling institutional confidence, the 36% volume decline presents near-term headwinds. The market appears to be in a consolidation phase before attempting the $1.20 breakout that traders are monitoring closely.

Factors Influencing ADA's Price

Cardano Whales Accumulate 20M ADA as Traders Eye $1.20 Breakout

Cardano's price action is gaining momentum as large holders amass 20 million ADA within 24 hours, triggering bullish sentiment among traders. The $0.93 level emerges as a critical threshold—a decisive breach could propel ADA toward $1.20, supported by 72% long-position dominance in derivatives markets.

Whale wallets holding 1M-10M ADA are rapidly reducing exchange supply, a pattern historically preceding upward surges. Meanwhile, MAGACOIN FINANCE draws speculative interest as a sub-$0.0005 altcoin, with early adopters anticipating 30x returns.

Cardano Faces Market Setback as Volume Crashes 36% and Price Declines

Cardano's trading volume plummeted 36.5% to $1.13 billion within 24 hours, reflecting dwindling investor interest. ADA's price fell 5.77% over the past week, struggling to maintain support above $0.90 as Bitget's delisting decision exacerbated selling pressure.

The altcoin mirrors broader market weakness, sliding from an intraday high of $0.9082 to $0.8897. This 0.85% daily decline underscores fading momentum toward the psychologically important $1 threshold. Market participants appear increasingly risk-averse, with the dramatic volume contraction signaling widespread hesitation.

Cardano's persistent marketing challenges continue undermining confidence. Without renewed institutional interest or ecosystem developments, ADA risks remaining trapped in its current consolidation pattern. The project's ability to regain traction now hinges on reversing negative sentiment across both retail and exchange channels.

What’s Stopping Cardano (ADA) Price From Smashing $1?

Cardano's struggle to breach the $1 mark reflects a clash between steady ecosystem growth and profit-taking by large holders. Despite bullish market sentiment and Bitcoin's momentum spilling into altcoins, ADA faces resistance at this psychological threshold.

Whale activity tells a cautionary tale. Holdings of 1 million to 10 million ADA have declined to 5.47 billion tokens, according to Santiment data analyzed by Ali. This divergence—rising prices amid decreasing whale balances—typically signals short-term selling pressure. The $1 level represents more than a number; it's a battleground where institutional hesitation meets retail trader expectations.

Will ADA Price Hit 1?

Based on current technical indicators and market sentiment, ADA shows strong potential to reach $1. The price currently trades above key moving averages, while whale accumulation of 20 million ADA indicates institutional confidence. However, the 36% volume decline suggests some near-term consolidation may occur before the breakthrough.

| Indicator | Value | Signal |

|---|---|---|

| Current Price | $0.8934 | Bullish |

| 20-Day MA | $0.8688 | Support |

| Upper Bollinger | $0.9450 | Resistance |

| MACD Histogram | -0.02096 | Improving |